Employers today know all too well the importance of conducting a background check on new hires. Their reasons however may vary as to why they perform background checks. In our recent infographic on “Why You Need to Background Check,” we graphically illustrated some of the reasons for background screening.

Employers today know all too well the importance of conducting a background check on new hires. Their reasons however may vary as to why they perform background checks. In our recent infographic on “Why You Need to Background Check,” we graphically illustrated some of the reasons for background screening.

Other reasons for employers to perform background checks include:

Employment screening can improve the overall quality of the workforce, ensuring that workers have the skills, experience and educational background stated during the interview process.

Recent news articles on child abuse have prompted most states to pass new laws and regulations requiring background checks on workers and volunteers who interact with children, the disabled or elderly persons.

Corporate scandals have given rise to greater scrutiny on corporate executives, officers, directors and business partners.

Resume fraud by job applicants has been on the rise, causing many employers to verify the information provided by job candidates during the interview.

Employers can be liable for negligent hiring lawsuits when an employee’s action brings harm to a co-worker, and it’s evident that the situation could have been reasonably prevented had a background check been performed.

Now that we know why background checks are important, how can we be assured that they are performed correctly?

Employment background checks can vary from a simple verification of the applicant’s Social Security number to a detailed account of the potential employee’s history, professional relationships and business interests.

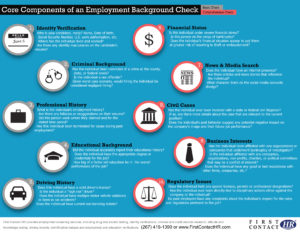

The following infographic graphic illustrates the core components of a basic employment background check as compared to a more comprehensive check. Consistent with Equal Employment Opportunity Commission (EEOC) guidance, employers should vary the level of background check based on the demands of the job.

For example, a bank teller position might require a basic check to include an identity verification, criminal history research, education and work history verifications, and a credit report. A bank executive screen might be more comprehensive to include the basic check in addition to a driving history search, news and media research, a civil records search and government database research, e.g., Securities and Exchange Commission records.